Venmo Fees

A 3 percent processing fee is added to every transaction paid for using a credit card.

Venmo fees. The 3 fee is not. Venmo does however charge a 3 percent fee on any amount you send to someone else using a credit card. Venmo also has no monthly or annual fees. You ll also be notified while adding a card that falls under this category.

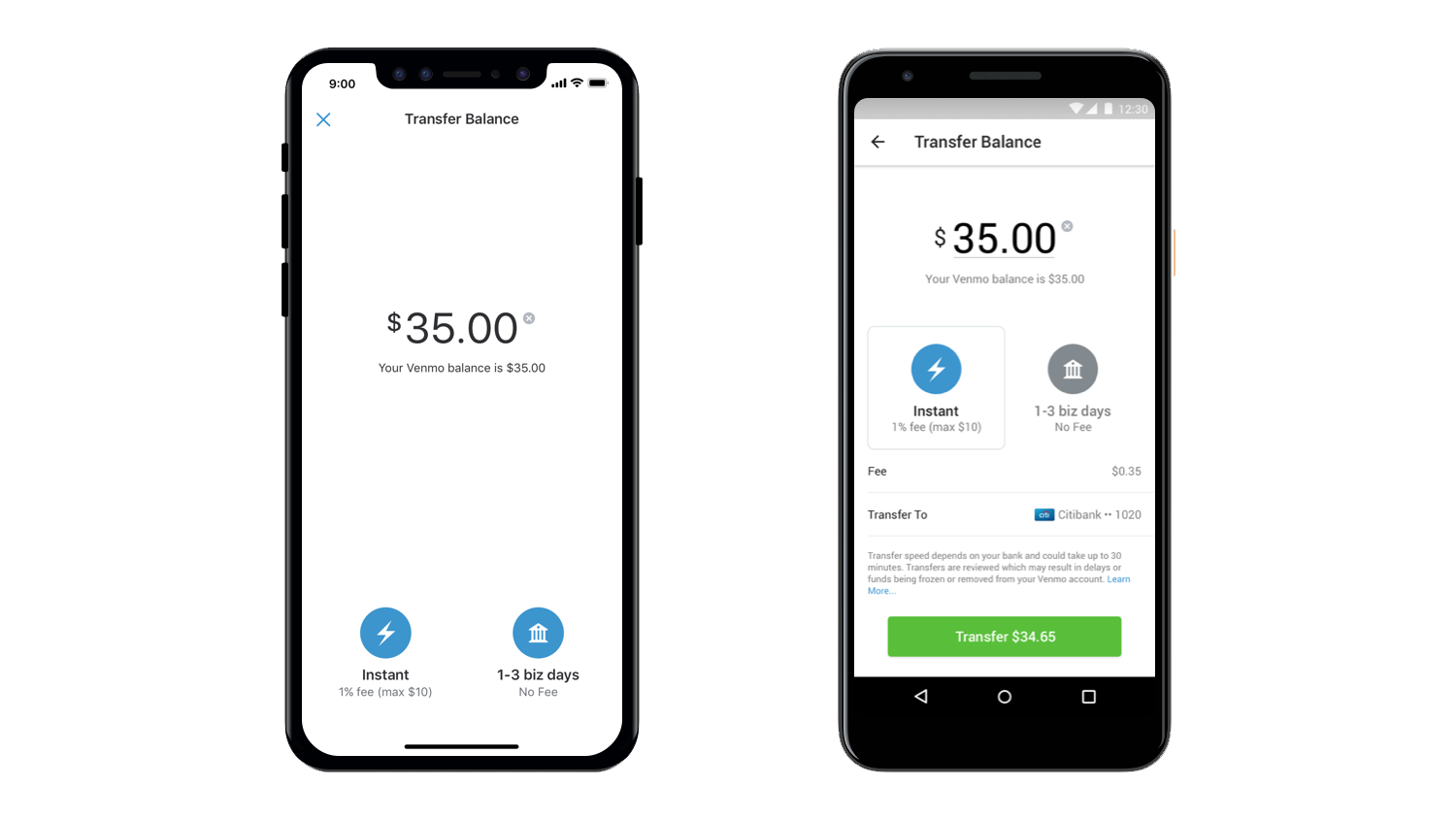

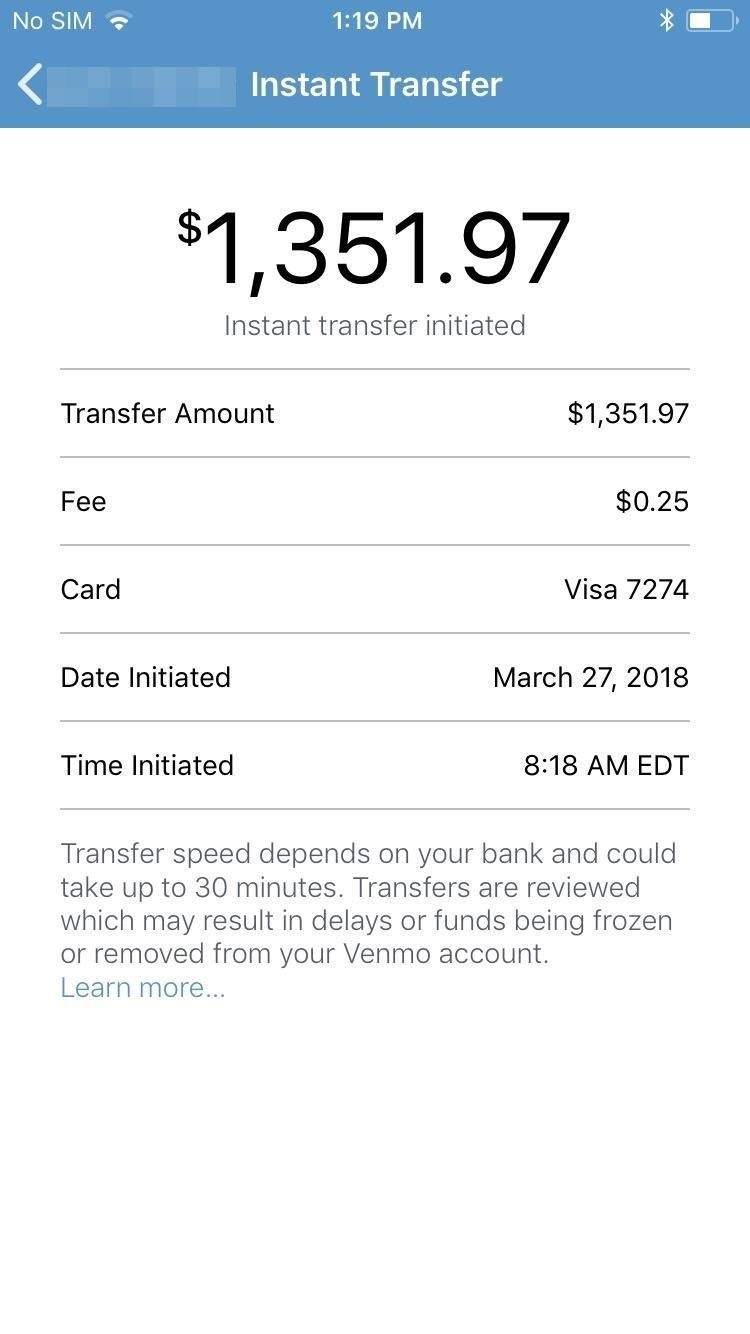

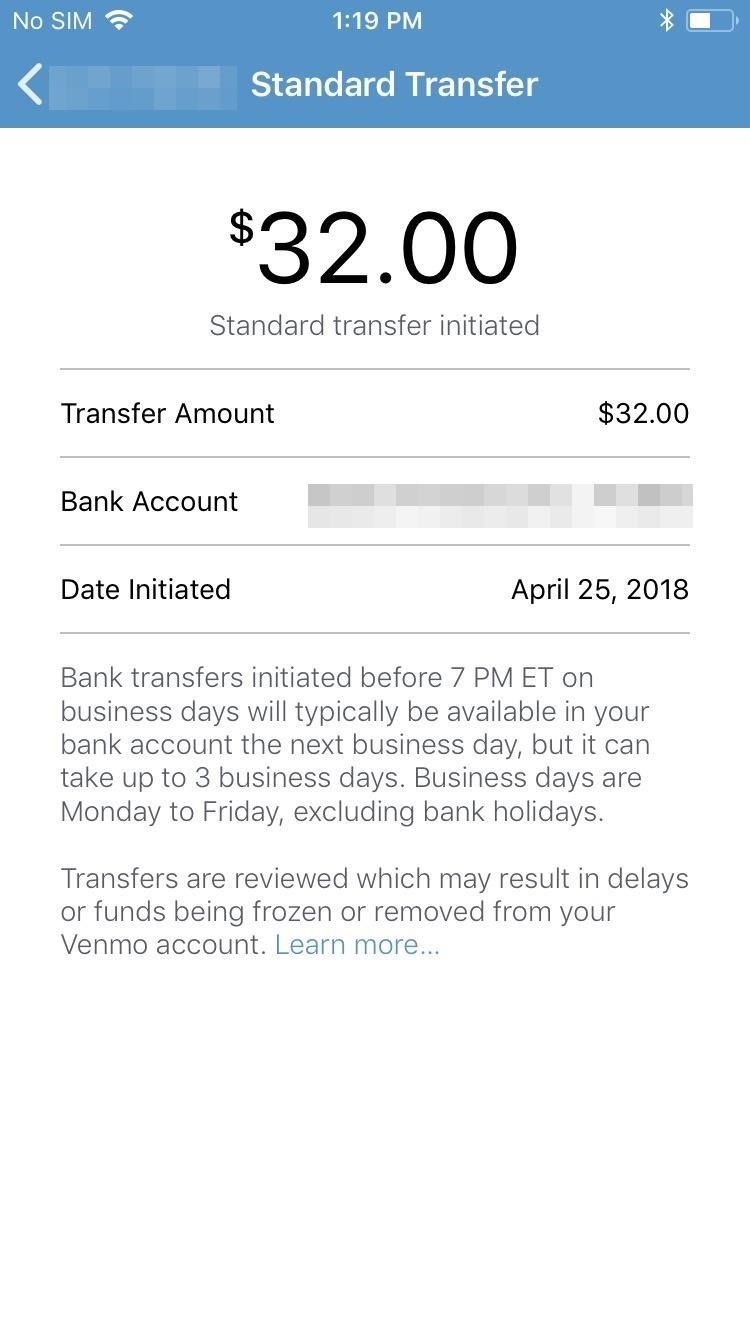

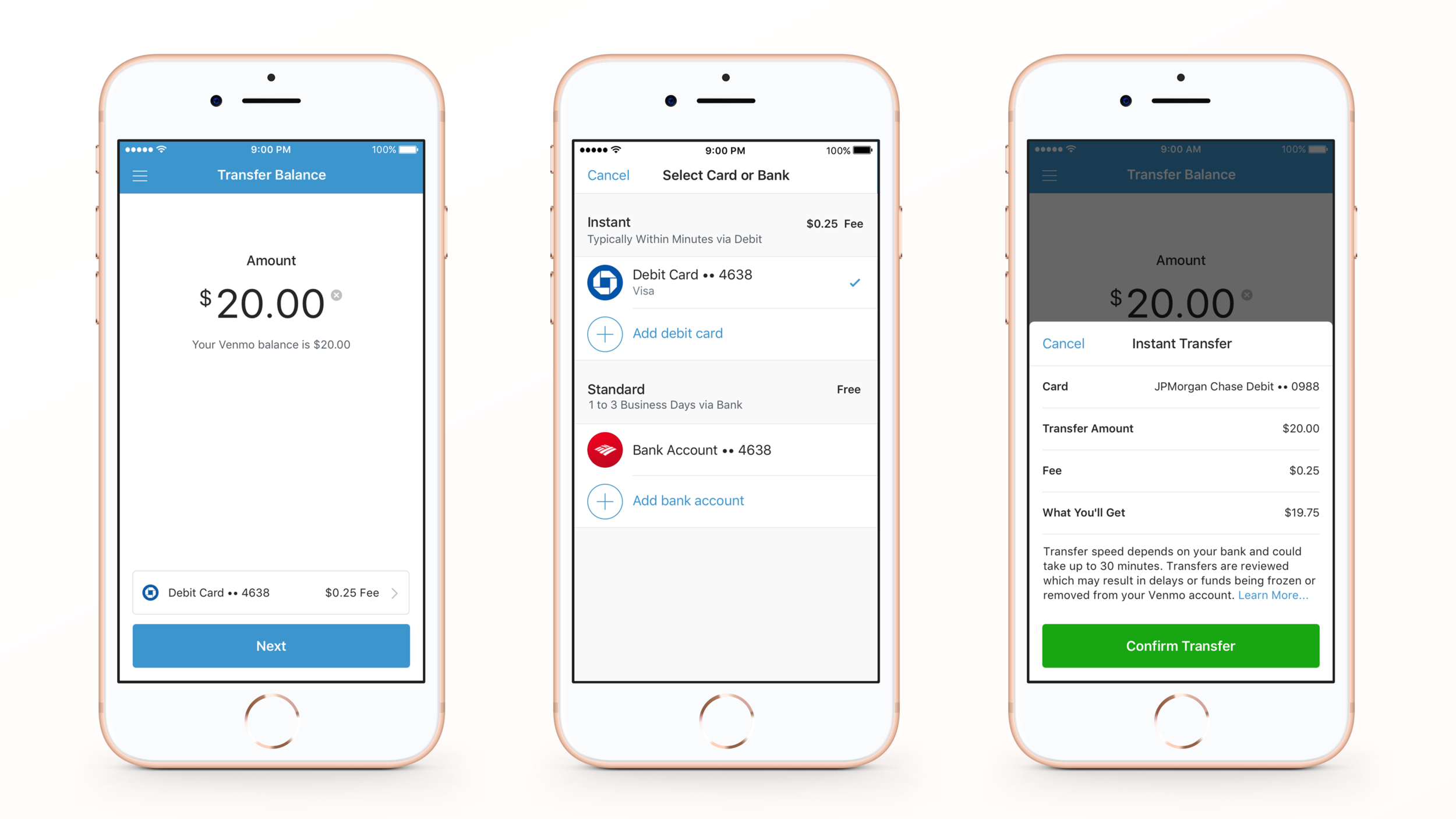

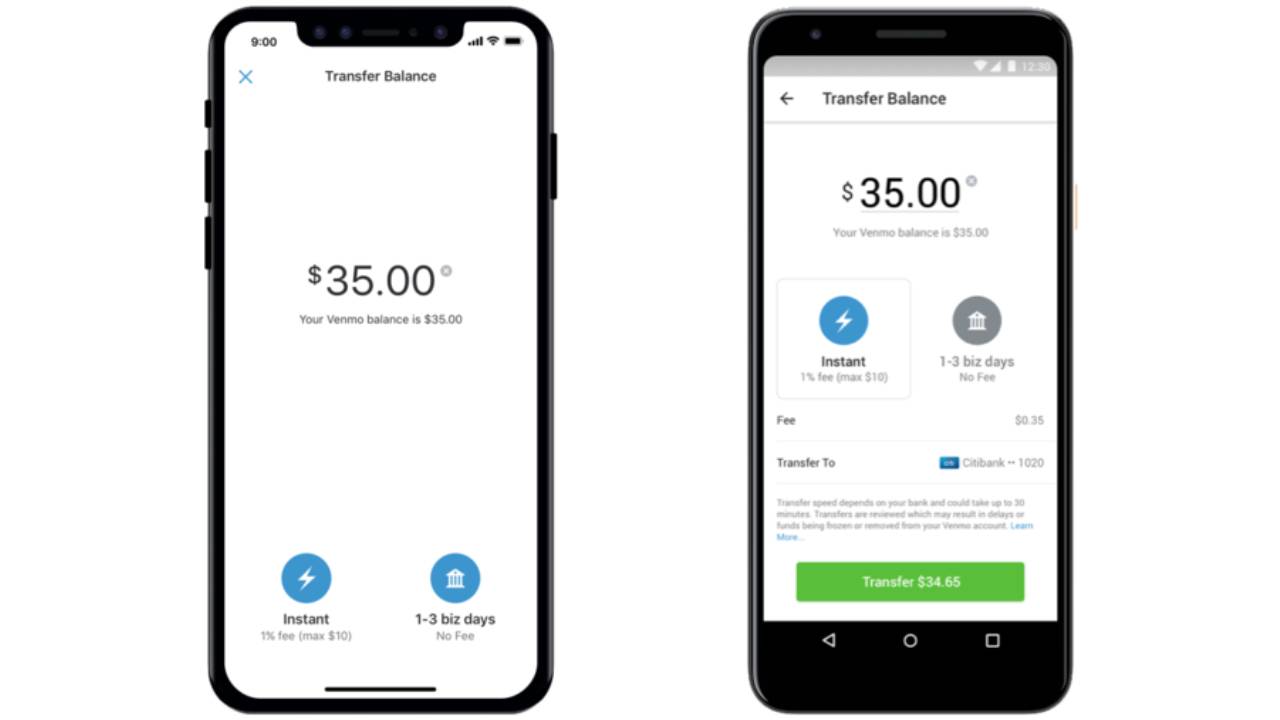

The company also charges you 25 cents if you choose an instant transfer of your venmo balance. Venmo simply passes this fee onto its customers. If you link a credit card there is a 3 fee on each transaction which originates from the credit card company itself. You can easily split the bill cab fare or much more.

Please see this page for more information about fees. Download the ios or android app. Fees venmo team venmo august 26 2020 22 40. Sending money over venmo triggers a standard 3 fee but the company waives that expense when the transaction is funded with a venmo balance a bank account or a debit card.

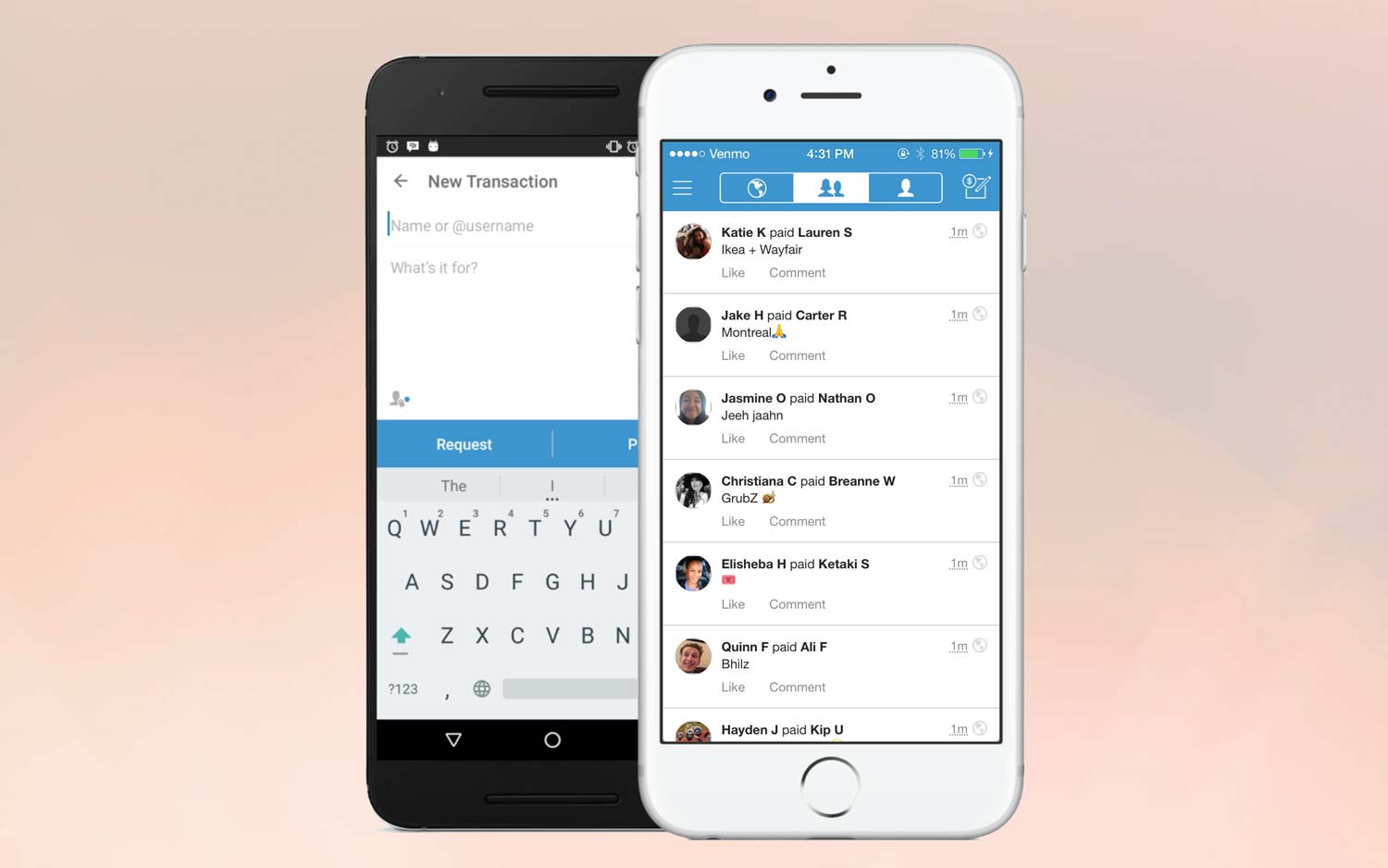

Venmo charges a three percent fee to send money from your credit card. If you want to see if your card carries a fee you can do so by going into your settings payment methods and tapping on the card. Venmo is a digital wallet that lets you make and share payments with friends. To verify your identity click the button at the top of the app tap settings and tap identity verification if you have completed identity verification your combined weekly spending limit is 6 999 99.

Over time this small service charge could add up particularly for anyone who sends multiple payments a day. Sending moneyfrom a linked bank account debit card or your venmo balance. Venmo doesn t charge for basic services like. Venmo does charge a fee in certain cases though it s pretty easy to avoid these fees depending on how you use the service.

:max_bytes(150000):strip_icc()/how-safe-venmo-and-why-it-free_FINAL-5c7d732a46e0fb00018bd86c.png)

/Venmo-ItsBusinessModelandCompetition2-7a04c392fba04909b3d5dd560a9782e3.png)